App Review

Design - 1.1

Speed - 1.9

Features - 5.4

Look & Feel - 4.1

Value for Download/Money - 3.8

3.3

Average

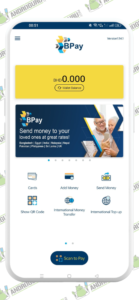

With seamless functionality and a user-friendly interface, it offers a range of services such as retail payments, peer-to-peer transfers, school fee payments, and more. It's a convenient and secure solution for residents and expats in Bahrain, providing them with efficient financial management on the go.

AFS BPay on Android is a feature-rich app that provides users with a convenient and efficient way to manage their financial transactions.

Whether it’s paying bills, transferring funds, or making purchases, this app offers a comprehensive solution for residents and expats residing in the Kingdom of Bahrain.

Note: In this app review, we have mentioned AFS BPay as BPay and we are referring to the same BPay app on Android which is backed by Arab Financial Services, and not any other BPay app outside the Kingdom of Bahrain.

Step 1: Download and Install

To start using the AFS BPay app on Android, the first step is to download and install the application. You can find the AFS BPay app on the Google Play Store by searching for “AFS BPay” or by directly accessing the app’s page using the provided link in the instructions.

Once you have located the AFS BPay app, tap on the “Install” button to initiate the download process. The app will begin to download and install on your Android device automatically. Make sure you have a stable internet connection to ensure a smooth and uninterrupted download.

After the installation is complete, you can find the AFS BPay app on your device’s home screen or in the app drawer. Tap on the app’s icon to launch it and proceed with the setup process.

During the initial setup, the app may ask for necessary permissions to access certain features on your device.

Grant the required permissions to allow the app to function optimally. These permissions may include access to your contacts, camera (for scanning QR codes), and storage (for saving transaction receipts).

It’s important to note that the AFS BPay app is compatible with Android devices running the latest version of the operating system. Ensure that your device meets the minimum system requirements to ensure optimal performance.

By following this step, you will have successfully downloaded and installed the AFS BPay app on your Android device, bringing you closer to experiencing its various features and functionalities.

Remember to periodically check for app updates on the Google Play Store to ensure you have the latest version of AFS BPay installed, as updates often bring bug fixes, security enhancements, and new features to enhance your user experience.

By proceeding to the next steps, you can explore the capabilities of the AFS BPay app and utilize its diverse range of financial services to simplify your transactions and manage your finances efficiently.

Step 2: Create an Account

By creating an account, you gain access to various features and functionalities of the app, allowing you to manage your finances and make transactions conveniently. Here’s a detailed explanation of how to create an account in the AFS BPay app:

- Download and Launch the AFS BPay App: Begin by downloading the AFS BPay app from the Google Play Store onto your Android device. Once the installation is complete, launch the app by tapping on its icon.

- Account Creation: On the app’s welcome screen, you will typically find an option to create a new account. Tap on this option to initiate the account creation process.

- Enter Personal Information: The AFS BPay app will prompt you to provide certain personal information necessary for creating your account. This may include details such as your full name, email address, contact number, and a secure password. Fill in the required fields with accurate information.

- Agree to Terms and Conditions: Read through the app’s terms and conditions, privacy policy, and any other relevant agreements. If you agree to abide by these terms, tick the checkbox or tap the “Agree” button to proceed.

- Verify Your Account: To ensure the security and integrity of the registration process, the AFS BPay app may require you to verify your account. This verification step can involve various methods, such as clicking on a verification link sent to your registered email address or entering a verification code sent to your mobile number. Follow the app’s instructions to complete the verification successfully.

- Set Up Security Measures: As a security measure, the AFS BPay app may provide options to set up additional security measures for your account. This can include setting up a PIN, pattern lock, or biometric authentication, such as fingerprint or face recognition. Configure the security settings according to your preferences to enhance the protection of your account.

- Complete Account Creation: After verifying your account and setting up the necessary security measures, the AFS BPay app will display a confirmation message indicating that your account has been successfully created. At this point, you can proceed to log in using your registered email address or username and the password you set during the account creation process.

- Exploring the App: Once you have created an account and logged in, you can begin exploring the various features and functionalities of the AFS BPay app. Familiarize yourself with the user interface, navigate through the different sections, and discover the tools available for managing your finances and making transactions.

- Account Management: The AFS BPay app typically provides options to manage your account settings, update personal information, and modify security settings. Take advantage of these features to customize your account according to your preferences and keep your information up to date.

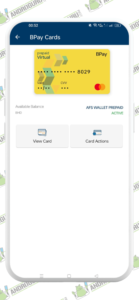

Step 3: Link Bank Account or Payment Card

By linking your preferred payment method, you can conveniently make transactions, pay bills, and transfer funds using the app. Here’s a detailed explanation of how to link your bank account or payment card in the AFS BPay app:

- Accessing the Payment Settings: To begin the process, open the AFS BPay app on your Android device and navigate to the payment settings section. This section is usually accessible through the app’s main menu or settings menu.

- Selecting Payment Method: Once you’re in the payment settings, you will find the option to add a new payment method. Tap on this option to proceed.

- Choosing Bank Account or Payment Card: The AFS BPay app offers the flexibility to link either your bank account or payment card. Select the appropriate option based on your preference and the payment method you want to link.

- Providing Required Information: Depending on whether you choose to link a bank account or payment card, the AFS BPay app will prompt you to provide the necessary information. This typically includes details such as your bank account number, routing number, card number, expiry date, and CVV (Card Verification Value) code. Ensure that you enter the information accurately to avoid any issues with future transactions.

- Verification Process: After entering the required information, the BPay app may initiate a verification process to ensure the validity and ownership of the linked bank account or payment card. This can involve various methods, such as a small transaction amount being deposited into your bank account or a verification code being sent to your card’s associated mobile number or email address. Follow the app’s instructions to complete the verification process successfully.

- Confirmation and Activation: Once the verification is complete, the AFS BPay app will display a confirmation message indicating that your bank account or payment card has been successfully linked. At this stage, you may be required to activate the payment method within the app by setting it as the default or specifying its use for specific transactions.

- Managing Linked Payment Methods: The BPay app provides options to manage your linked payment methods. You can add additional bank accounts or payment cards, remove existing ones, or make changes to the default payment method. This flexibility allows you to adapt to your evolving financial needs and preferences.

- Security and Privacy: AFS BPay prioritizes the security and privacy of your linked bank accounts and payment cards. The app employs encryption and other security measures to safeguard your financial information. It also adheres to strict privacy policies to ensure the confidentiality of your personal data.

Please note that the availability of linking bank accounts or payment cards in the AFS BPay app may vary depending on the specific features and partnerships of the app in your region. Ensure that you check the app’s settings and supported payment methods to determine the options available to you.

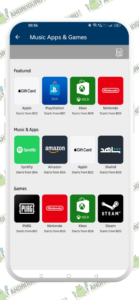

Step 4: Explore Features

Once your account is set up and linked to your preferred payment method, you can begin exploring the various features of the AFS BPay app. The app provides options for bill payments, school fee payments, peer-to-peer transfers, and retail payments.

The AFS BPay app on Android offers a wide range of features and functionalities that can be utilized for various purposes.

In this step, we will explore how this app can be used for different tasks and transactions, making it a versatile tool for residents and expats residing in the Kingdom of Bahrain.

- Mobile Payments: The AFS BPay app allows users to make mobile payments conveniently. By linking your bank account or adding funds to your AFS BPay wallet, you can easily make payments for a wide range of services such as utility bills, online purchases, dining, shopping, and more. Simply select the desired payment option within the app, enter the payment details, and authorize the transaction to complete the payment securely and efficiently.

- Money Transfers: With the AFS BPay app, you can also transfer money to other AFS BPay users or even to individuals who do not have the app. The app supports seamless peer-to-peer transfers, enabling you to send money to friends, family, or businesses instantly. You can simply enter the recipient’s mobile number or scan their QR code to initiate the transfer. AFS BPay ensures the security and privacy of your transactions, making money transfers hassle-free.

- Transaction History and Receipts: The AFS BPay app keeps a record of your transactions, allowing you to easily track your payment history. You can view detailed information about each transaction, including the date, time, recipient, and amount. The app also provides digital receipts for your transactions, eliminating the need for paper receipts and providing a convenient way to keep track of your expenses.

- Bill Reminders and Alerts: AFS BPay offers a useful feature that sends bill reminders and alerts to help you stay on top of your payments. You can set up reminders for recurring bills, such as rent, utilities, and subscriptions, ensuring that you never miss a payment deadline. The app sends notifications and reminders to your device, keeping you informed and helping you maintain good financial management.

- Currency Conversion: For expats residing in Bahrain, the AFS BPay app provides a built-in currency conversion feature. You can easily convert currencies within the app, enabling you to quickly check exchange rates and make informed decisions when dealing with international transactions or traveling abroad.

These are just a few examples of how the AFS BPay app can be used for various purposes. Its versatility and user-friendly interface make it a valuable tool for managing finances, making payments, and staying organized with your transactions.

By exploring the diverse uses of the AFS BPay app, you can leverage its features to simplify your financial tasks, save time, and enjoy a convenient and secure payment experience.

Step 5: Bill Payments

To pay bills using AFS BPay, navigate to the bill payment section within the app. Enter the necessary details, such as the biller’s information, invoice number, and amount to be paid. Review the information and confirm the payment. AFS BPay securely processes the transaction and provides a confirmation receipt.

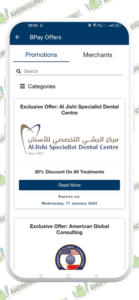

The AFS BPay app on Android offers a range of features and benefits that cater specifically to the needs of residents and expats residing in the Kingdom of Bahrain.

In this step, we will focus on how AFS BPay can be useful for these individuals, providing them with convenient and efficient financial management solutions.

- Seamless Local Payments: With AFS BPay, residents and expats in Bahrain can easily make payments for various local services. Whether it’s settling utility bills, paying for groceries, dining at restaurants, or purchasing goods and services, the app provides a seamless payment experience. Users can link their bank accounts, add funds to their AFS BPay wallet, and initiate payments securely and swiftly, eliminating the need for cash transactions.

- International Money Transfers: Expats residing in Bahrain often need to send money to their home countries or to individuals abroad. AFS BPay simplifies this process by offering international money transfer capabilities. Users can initiate transfers with competitive exchange rates, ensuring that their funds reach the intended recipients efficiently and cost-effectively.

- Multi-Currency Support: For expats dealing with multiple currencies, AFS BPay offers the convenience of multi-currency support. The app enables users to hold and transact in different currencies within their AFS BPay wallet, eliminating the hassle of converting funds manually or dealing with fluctuating exchange rates. This feature proves especially valuable for expats who frequently travel or engage in cross-border transactions.

- Secure and Transparent Transactions: AFS BPay prioritizes the security and privacy of its users’ transactions. The app employs robust encryption protocols and security measures to safeguard sensitive information, ensuring that payments and personal data remain protected. Additionally, BPay provides transparent transaction records, allowing users to track their financial activities and review detailed transaction histories.

- Simplified Bill Management: Managing recurring bills can be a time-consuming task, but BPay streamlines the process. Users can set up bill reminders and alerts, ensuring that they never miss payment deadlines. By receiving timely notifications and reminders, residents and expats can stay organized and maintain good financial management practices.

- Convenient Financial Tracking: AFS BPay keeps a comprehensive record of users’ transactions, offering a centralized platform to track and monitor their financial activities. Users can access transaction histories, view receipts, and categorize expenses, providing valuable insights into their spending patterns. This feature empowers residents and expats to make informed financial decisions and effectively manage their budgets.

- User-Friendly Interface: The BPay app boasts a user-friendly interface that makes navigation and usage intuitive for both residents and expats. The app’s design focuses on simplicity and ease of use, ensuring a seamless and enjoyable user experience. From account creation to making payments and accessing transaction details, BPay provides a hassle-free interface that caters to users of all levels of technological proficiency.

By leveraging the benefits of AFS BPay, residents and expats in Bahrain can streamline their financial activities, simplify payment processes, and enhance their overall financial management. The app’s tailored features and user-centric approach contribute to a convenient and efficient experience, empowering users to stay in control of their finances.

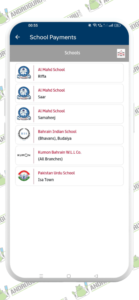

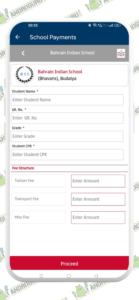

Step 6: School Fee Payments

The BPay app provides a hassle-free way for parents and guardians to pay their children’s school fees directly from their Android device.

Here’s a detailed explanation of how school fee payments work with the BPay app:

- Selecting the School: To initiate a school fee payment, you need to select the respective educational institution from the list of supported schools within the AFS BPay app. The app typically provides a comprehensive directory of affiliated schools, making it easy for you to find and choose your child’s school.

- Accessing the Fee Details: Once you have selected the school, the AFS BPay app will display the fee details specific to your child’s education. This includes information such as the fee amount, due date, and any other associated charges or fees. You can review these details to ensure accuracy and avoid any delays in payment.

- Payment Options: The AFS BPay app offers multiple payment options to facilitate school fee payments. You can link your preferred payment method, such as a debit card, credit card, or bank account, to the app. This allows for convenient and secure transactions when making school fee payments.

- Authorization and Authentication: Before completing the payment, the BPay app may require additional authorization or authentication steps to ensure the security of your transaction. This could involve verifying your identity through biometric authentication (fingerprint or face recognition) or entering a secure PIN or password associated with the app. These measures help protect your financial information and prevent unauthorized payments.

- Confirmation and Receipt: Once you have reviewed the fee details and completed the required authorization steps, the BPay app will display a confirmation screen. Verify the payment amount, due date, and any additional notes associated with the transaction. Upon confirmation, the app securely communicates the payment information to process the school fee payment. You will receive a receipt or confirmation of the payment for your records.

- Transaction History and Records: The BPay app maintains a transaction history, allowing you to access and track your school fee payments. You can review past payments, including details such as the date, time, school, and payment amount. This feature provides a comprehensive overview of your child’s school fee transactions, enabling you to stay organized and monitor your payment history.

- Notifications and Reminders: To help you stay on top of your child’s school fee payments, the AFS BPay app may offer notifications and reminders. These alerts can be set to remind you of upcoming due dates, ensuring that you never miss a payment deadline. This feature helps you stay proactive and manage your financial obligations effectively.

- Security and Privacy: AFS BPay prioritizes the security and privacy of your school fee payments. The app employs encryption and other security measures to safeguard your financial information during the payment process. It also adheres to strict privacy policies to ensure the confidentiality of your personal data.

Please note that the availability of school fee payments through the AFS BPay app may depend on the specific educational institutions and their partnership with AFS BPay. Ensure that you check the app’s features and supported schools to determine if your child’s school is included.

Step 7: Peer-to-Peer Transfers

Peer-to-peer transfers allow you to send money directly to other individuals using the app, offering a convenient and secure way to split bills, repay debts, or send funds to friends and family.

Here’s a detailed explanation of how peer-to-peer transfers work with the AFS BPay app:

- Adding Recipients: To initiate a peer-to-peer transfer, you need to add the recipient as a contact within the BPay app. The app typically provides options to add contacts manually by entering their details or by importing them from your device’s contact list. Once the recipient’s information is saved, you can easily select them for future transfers.

- Transfer Amount and Currency: When initiating a peer-to-peer transfer, you need to specify the amount of money you want to send. The AFS BPay app may support various currencies depending on your region or the recipient’s location. Ensure that you select the appropriate currency for the transfer to accurately reflect the monetary value.

- Authorization and Authentication: Before completing the transfer, the AFS BPay app may require additional authorization or authentication steps to ensure the security of your transaction. This could involve verifying your identity through biometric authentication (fingerprint or face recognition) or entering a secure PIN or password associated with the app. These measures help protect your financial information and prevent unauthorized transfers.

- Confirmation and Review: After specifying the transfer amount and completing the required authorization steps, the AFS BPay app will display a confirmation screen. Review the details of the transfer, including the recipient’s name, transfer amount, and any additional notes or messages you want to include. Verify that all information is correct before proceeding with the transaction.

- Completing the Transfer: Once you confirm the transfer details, the AFS BPay app securely communicates the transaction information to process the transfer. The app facilitates the transfer of funds from your linked payment method to the recipient’s account, ensuring a seamless and efficient transfer process. Upon successful completion, the app may provide a confirmation message or receipt for your records.

- Transaction History and Records: The AFS BPay app keeps a record of your peer-to-peer transfers, allowing you to access and track your transaction history. You can review past transfers, including details such as the date, time, recipient, and amount sent. This feature enables you to maintain a comprehensive overview of your financial transactions.

- Security and Privacy: AFS BPay prioritizes the security and privacy of your peer-to-peer transfers. The app employs encryption and other security measures to safeguard your financial information during the transfer process. It also adheres to strict privacy policies to ensure the confidentiality of your personal data.

It’s important to note that the availability of peer-to-peer transfers through the BPay app may depend on factors such as your location and the recipient’s location. Ensure that you check the app’s features and supported regions to determine its usability for peer-to-peer transfers in your area.

Step 8: Retail Payments

The app provides a convenient and secure way to make purchases at various retail establishments, allowing you to streamline your shopping experience and manage your transactions efficiently. Here’s a detailed explanation of how retail payments work with the AFS BPay app:

- Payment Options: The AFS BPay app offers multiple payment options to cater to different preferences and needs. You can link your bank account, credit or debit card, or other payment methods to the app for seamless transactions. The app may also support digital wallets or payment platforms, enabling you to make payments using stored funds or linked accounts.

- Merchant Integration: AFS BPay collaborates with various retail merchants to integrate their payment systems with the app. This integration enables you to use the BPay app as a payment method at participating stores, restaurants, and other retail establishments. Look for the BPay logo or ask the merchant if they accept payments through the app.

- Scanning QR Codes: To initiate a retail payment using the AFS BPay app, you will typically need to scan a QR code provided by the merchant. The QR code contains specific transaction details, such as the payment amount and merchant information. Open the BPay app on your Android device, navigate to the payment section, and use the app’s built-in QR code scanner to capture the code displayed by the merchant.

- Confirming Payment Details: Once the QR code is scanned, the AFS BPay app will display the payment details on your screen, including the merchant name, payment amount, and any additional information required. Carefully review the details to ensure accuracy before proceeding with the payment.

- Authorization and Authentication: Before completing the payment, the AFS BPay app may require additional authorization or authentication steps for security purposes. This could involve verifying your identity through biometric authentication (fingerprint or face recognition) or entering a secure PIN or password associated with the app. These measures help protect your financial information and prevent unauthorized usage.

- Completing the Transaction: After confirming the payment details and successfully completing the required authorization steps, you can proceed to finalize the transaction. The BPay app securely communicates the payment information to the merchant’s system, initiating the transfer of funds from your selected payment method to the merchant’s account. Upon successful completion, the app will provide a confirmation message or receipt for your records.

- Transaction History and Receipts: The AFS BPay app keeps a record of your retail transactions, allowing you to view and track your payment history. You can access this information within the app, providing a convenient way to monitor your expenses and reconcile your purchases.

- Security and Fraud Protection: AFS BPay takes the security of retail payments seriously. The app employs encryption and other security measures to protect your payment information during the transaction process. Additionally, the app may have built-in fraud detection systems to identify and prevent fraudulent activities, providing you with peace of mind while making retail payments.

It’s important to note that the availability of retail payments through the AFS BPay app may vary depending on the participating merchants and the region in which you are located. Ensure that you check the app’s features and supported merchants to determine its usability for retail payments in your area.

By leveraging the retail payment capabilities of the AFS BPay app, you can enjoy a convenient, cashless shopping experience while securely managing your transactions from your Android device.

Step 9: Pre-Requisites

Before users can fully utilize the features and functionalities of the AFS BPay app on Android, there are certain pre-requisites that need to be fulfilled to create an account.

In this step, we will outline the key requirements and steps involved in setting up an account on the app.

- Download and Install the AFS BPay App: The first step is to download the BPay app from the Google Play Store. Users can search for the app using the app’s name, “BPay,” and click on the appropriate search result to access the app’s download page. Once on the download page, click on the “Install” button to initiate the installation process. The app will be downloaded and installed on the Android device.

- Account Registration: After the installation is complete, users need to open the AFS BPay app on their Android device. They will be prompted to create a new account to start using the app’s services. To register, users must provide certain details, such as their name, email address, and mobile number. It is important to provide accurate information to ensure a smooth registration process.

- Verification Process: Once the registration details are provided, the AFS BPay app may require users to verify their email address or mobile number. Users may receive a verification code via email or SMS, which they need to enter into the app to complete the verification process. This step ensures the security and authenticity of user accounts.

- Linking Bank Account: To fully utilize the payment features of the AFS BPay app, users will be prompted to link their bank account to their AFS BPay wallet. This process typically involves providing the necessary account details, such as the account number and bank name. The app may employ secure encryption protocols to ensure the confidentiality of sensitive information.

- Setting Up Security Measures: AFS BPay prioritizes the security of user accounts. As part of the account setup process, users may be required to set up security measures such as a secure PIN or biometric authentication (fingerprint or face recognition). These security measures add an extra layer of protection to the app and help prevent unauthorized access.

- App Permissions: During the installation and setup process, the AFS BPay app may request certain permissions to access specific features or data on the user’s Android device. These permissions may include access to the device’s camera (for scanning QR codes), location information (for proximity-based services), or contacts (for facilitating payments to contacts). Users can review and grant these permissions based on their comfort level and the app’s functionality requirements.

By following these pre-requisites and steps, users can create an account on the BPay app and begin using its features to facilitate seamless payments, financial management, and other services.

It is important to ensure that all information provided during the registration process is accurate and to maintain the security of the account by adhering to recommended security practices.

In conclusion, AFS BPay on Android offers a user-friendly and feature-packed app that caters to the diverse financial needs of residents and expats in the Kingdom of Bahrain.

With its wide range of functionalities, including bill payments, school fee payments, peer-to-peer transfers, and retail payments, BPay simplifies financial transactions and provides a convenient solution for managing finances.

[button color=”green” size=”small” link=”https://play.google.com/store/apps/details?id=com.afs.bpay&hl=en_IN&gl=US” icon=”fa-brands fa-android” target=”true” nofollow=”true” sponsored=”false”]Download App[/button]

We would love to hear your thoughts, experiences, and suggestions about this app on Android in the comments below.

2 Comments